Are you planning to expand your business in the Philippines but don’t know where to begin? One of the legal steps you must take is registering your business or entity at the Bureau of Internal Revenue (BIR), known as BIR Registration. This process allows you to legally operate in accordance with Philippine law, pay the necessary taxes, and issue official receipts.

But for you to be able to complete the BIR Registration, you must need a registered business address. This is where a Virtual Office becomes a smart and cost-efficient solution.

In this article, we’ll discuss everything you need to know, including BIR online registration and how Akasya Virtual Office makes it all possible.

Why Do You Need to Process BIR Registration?

BIR Registration is the process of officially registering your business, freelance work, or profession for the purpose of tax compliance such as applying for a Tax Identification Number (TIN), securing a BIR Certificate of Registration to issue Official Receipts and Invoices, and register books of accounts that serve as the official records of the business transactions for the fiscal year.

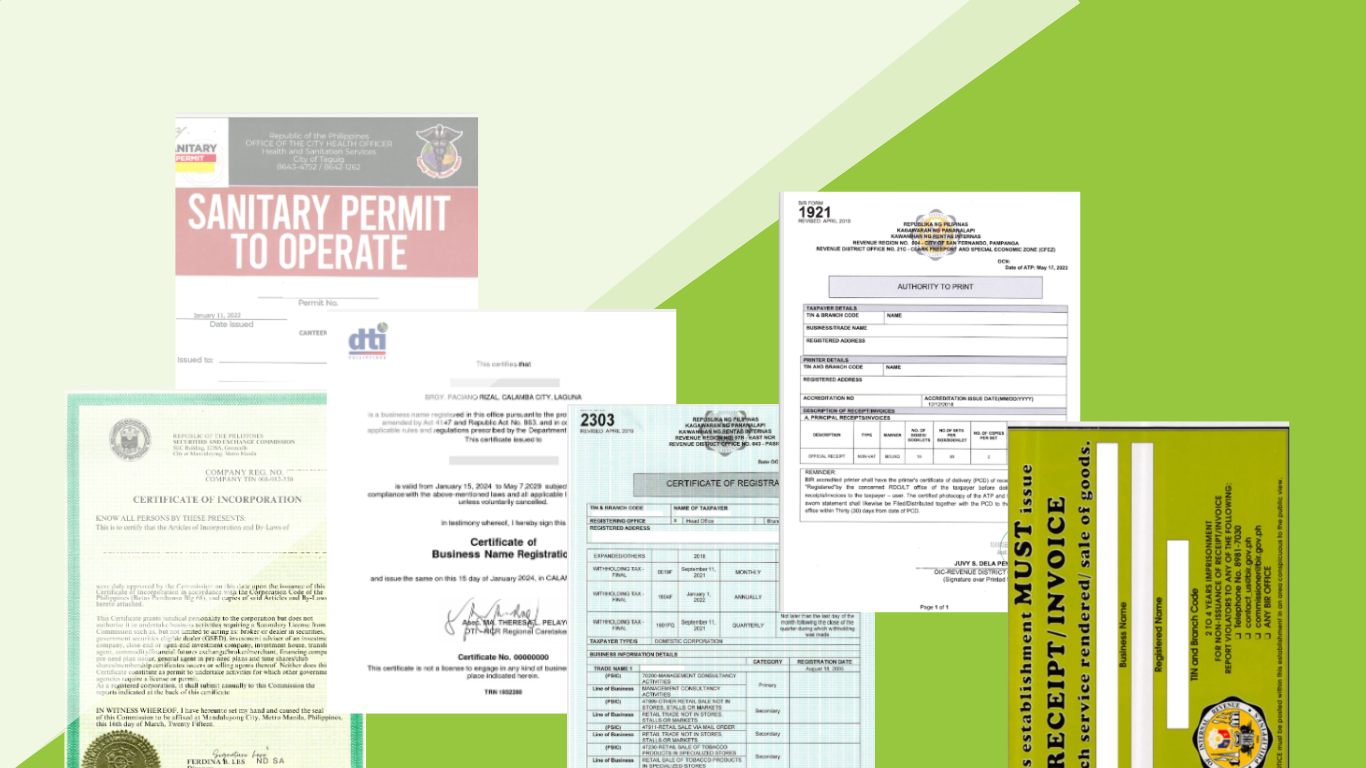

Once the registration is completed, the BIR will issue a BIR Form 2303, or also known as the Certificate of Registration (COR), Authority to Print (ATP), and Registered Books of Accounts.

What is a BIR Certificate of Registration?

The BIR Certificate of Registration (COR), also known as BIR Form 2303, is the official document that proves that you’re officially a registered taxpayer and allows you to issue official receipts, pay taxes, and access other government benefits and services.

This is also needed for bank account opening, applying for business permits, and client onboarding, especially with corporations.

BIR Certificate of Registration Sample

Sample of BIR Certificate of Registration (COR) – BIR Form 2303

The Importance of a Virtual Office for BIR Registration

If you are planning to expand your business in the Philippines but don’t have a physical office yet, a virtual office is your best solution. A Virtual Office is a legally registered business address that you can use for BIR Registration and other government filings without the need to rent a physical space.

This is very helpful for entities such as sellers, freelancers, startups, and remote businesses because of its lower cost compared to renting a physical office, and helps especially foreign entities set up and register their business while abroad.

What are the BIR Registration Requirements?

The BIR documentary requirements for registration depend on the type of business structure. It is advisable always to check the BIR official website, www.bir.gov.ph online registration, or contact your respective Revenue District Office (RDO) for updates.

Sole Proprietorships and Professionals

Here are the documentary requirements needed for BIR Registration of sole proprietorships, professionals, and self-employed:

BIR Form 1901 – Application for Registration (for self-employed single proprietors or professionals, mixed-income individuals, non-resident aliens engaged in trade or business, estates, and trusts)

BIR Form 1906 – Application for Authority to Print Invoices (for printing of receipts, if applicable)

BIR Form 1905 – Application for Registration Information Update, Correction or Cancellation (for registration of the books of accounts)

DTI Certificate of Registration

Occupational Tax Receipt (OTR) form the City or Municipal Hall (for freelancers, if applicable)

A valid government-issued ID (e.g., PRC, driver’s license, passport, etc.)

Notarized Contract of Lease, Affidavit of No Rent, Copy of Property Title (whichever applies)

BIR-printed receipts and invoices (for purchase) or final and clear samples of own receipts and invoices (for printing by a BIR-accredited partner)

Books of Accounts (general journal, general ledger, etc.)

Business under Partnerships and Corporations

Here are the documentary requirements needed for BIR Registration of partnerships and corporations:

BIR Form 1903 – Application for Registration (for corporations, partnerships, including GAIs, LGUs. cooperatives and associations)

BIR Form 1906 – Application for Authority to Print Invoices (for printing of receipts, if applicable)

BIR Form 1905 – Application for Registration Information Update, Correction or Cancellation (for registration of the books of accounts)

Photocopy of SEC Certificate of Incorporation (for corporations) or Certificate of Recording (for partnerships)

Articles of Incorporation (for corporations) or Articles of Partnership (for partnerships)

Photocopy of License to Do Business in the Philippines (for foreign corporations)

Board Resolutions and Secretary’s Certificates

Notarized Contract of Lease, Affidavit of No Rent, Copy of Property Title (whichever applies)

BIR-printed receipts and invoices (for purchase) or final and clear samples of own receipts and invoices (for printing by a BIR-accredited partner)

Books of Accounts (general journal, general ledger, etc.)

Business under Cooperatives

Here are the documentary requirements needed for BIR Registration of cooperatives and associations:

BIR Form 1903 – Application for Registration (for corporations, partnerships, including GAIs, LGUs. cooperatives and associations)

BIR Form 1906 – Application for Authority to Print Invoices (for printing of receipts, if applicable)

BIR Form 1905 – Application for Registration Information Update, Correction or Cancellation (for registration of the books of accounts)

Photocopy of CDA Certificate of Registration

Articles of Cooperation

Notarized Contract of Lease, Affidavit of No Rent, Copy of Property Title (whichever applies)

BIR-printed receipts and invoices (for purchase) or final and clear samples of own receipts and invoices (for printing by a BIR-accredited partner)

Books of Accounts (general journal, general ledger, etc.)

Additional BIR Requirements

Listed below are the additional documentary requirements that are needed, depending on the business structure or other circumstances:

Work visa (9g) for foreign nationals

Franchise documents and agreements, if a franchise business

Memorandum of Agreement for joint ventures

Certificate of Authority, if registered as a Barangay Micro Business Enterprises (BMBE)

Proof of Registration or Permit to Operate from the BOI, BOI-ARMM, PEZA, BCDA, TIEZA, TEZA, SMBA, etc

Special Power of Attorney (SPA) and any government-issued ID, if through authorized personnel

BIR Online Registration via NewBizReg Portal

To modernize and improve accessibility, the BIR launched its online registration system that allows taxpayers to submit their BIR registration documents digitally through the NewBizReg Portal. However, full implementation is not yet achieved and still requires individuals or businesses to submit their application physically at their assigned RDO.

BIR Registration Process

Here are the steps you need to follow for BIR registration:

Step 1: Prepare Documentary Requirements

Gather all necessary documents such as SEC or DTI registration, valid ID, proof of address (e.g., lease contract or virtual office agreement), and fill out applicable BIR forms. For online registration, scan and format documents properly for upload.

Step 2: Submit Your Application

File your application at the appropriate BIR RDO based on your business address.

Step 3: Pay the Registration Fees

The fees of BIR Registration depend on the structure of the business. These are the common fees that you sould pay:

Documentary Stamp Tax on Shares (DST Shares)

For stock corporations, the tax is ₱2 for every ₱200 of issued shares with par value.

Documentary Stamp on Lease (DST Lease)

If you’re renting a business space, the DST is ₱3 for the first ₱2,000 of the lease contract and ₱1 for every additional ₱1,000 thereafter.

Loose Documentary Stamp Tax

A ₱30 DST is required for the BIR Certificate of Registration (COR).

Annual Registration Fee

Under the Ease of Paying Taxes (EOPT) Act, the ₱500 annual registration fee has been removed, effective January 22, 2024, for both new and existing businesses.

Other Fees

Books of accounts, receipts, or invoices may also be purchased directly from the BIR RDO. The cost of books of accounts is around ₱60 each, and receipts or invoices cost around ₱1,500 for 10 booklets.

Final Thoughts

BIR Registration is essential for legally operating your business in the Philippines. Under their regulations, applicants must still appear in person at their assigned RDO to complete the process and claim the BIR Certificate of Registration (Form 2303)—a requirement still in place due to limited system automation.

Having a virtual office is a smart move, offering a compliant business address, helping determine your RDO, and supporting registration without the overhead of physical office space.

With the right guidance and in coordination with FilePino,Inc., you can streamline the entire process—from gathering your BIR Registration Requirements, paying Documentary Stamp Taxes (DST), to securing your BIR TIN (Tax Identification Number Online Registration and BIR COR and ensuring full compliance.

Registering your business is just the beginning. Let FilePino help you do it right, efficiently, and fully compliant.