Based on the Philippine Statistics Authority (PSA) report, the Philippine economy grew by 5.4% in the first quarter of 2025 compared to the same period last year. This growth means that the country produced more goods and services than it did in early 2024, proving that the country is a growing economy. The main contributors to this growth were wholesale and retail trade.

The majority of the entrepreneurs see this growth as an opportunity to establish a business in the Philippines. According to the Department of Trade and Industry (DTI), there are over 957,620 commercial companies in operation. This shows that the country is considered as an ideal destination for establishing a business and taking advantage of the growing markets and competent workforce.

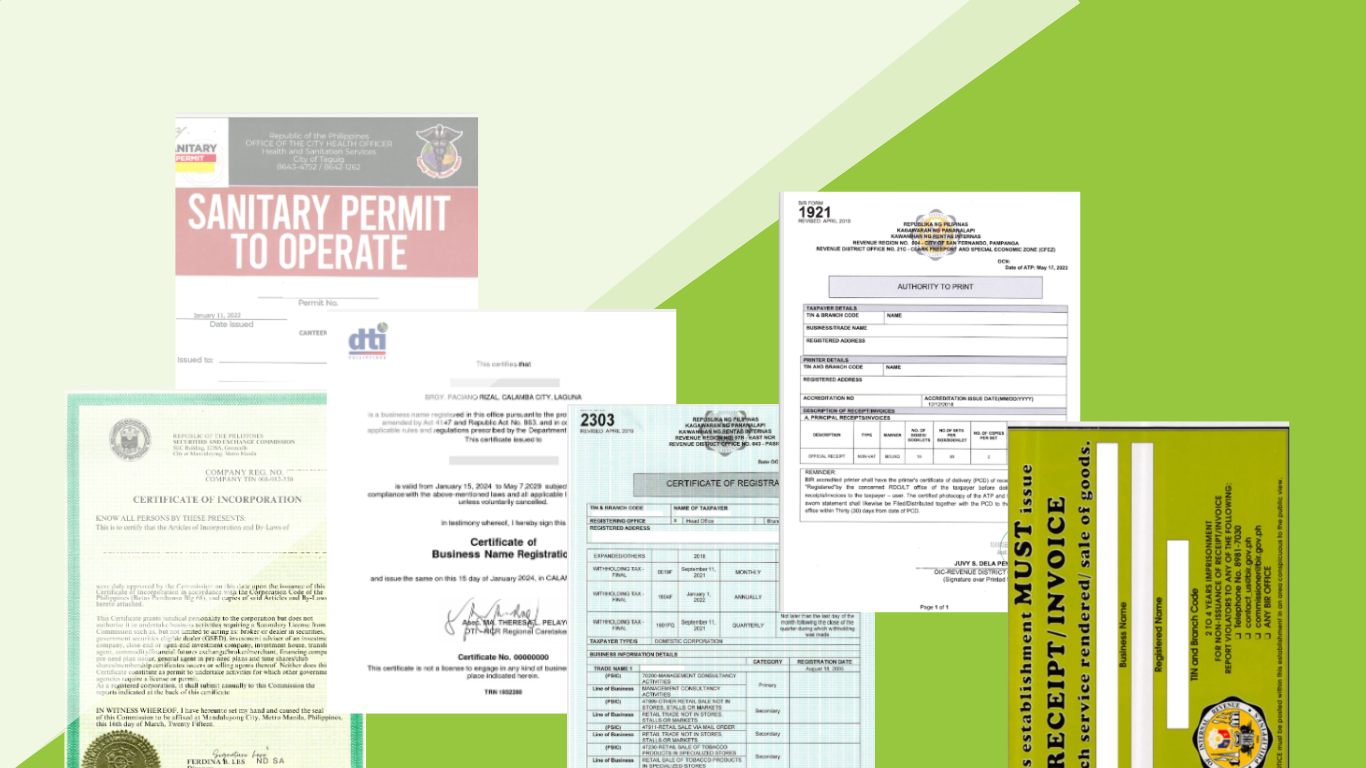

Registering a business in the Philippines may be challenging especially as there are a lot of documentary requirements to be submitted and regulations to be followed. In this comprehensive guide, you’ll learn about the business registration process, requirements, and costs with the Philippine governments.

Business Registration Process in the Philippines

Here’s a step-by-step guide of the business registration process:

STEP 1: Register with SEC, DTI or CDA

To initiate the process, register your business with the Securities and Exchange Commission (SEC) for partnerships and corporations; Department of Trade and Industry (DTI) for sole proprietorship; and Cooperative Development Authority (CDA) for cooperatives.

STEP 2: Get a Barangay Clearance and Mayor’s Permit

Visit the Barangay Hall or Office of the Barangay Captain of the Barangay with jurisdiction on your business address. Submit the required documents and pay the necessary fees to secure a Barangay Business Clearance.

Once you have secured the clearance, you may now process your LGU Business Permit or Mayor’s Permit with the Business Permits and Licensing Office (BPLO) or Business One-Stop Shop (BOSS) at your city or municipality.

STEP 3: Register with BIR

Even though your Mayor’s Permit is still in process, you can register your business with the Bureau of Internal Revenue (BIR) for the issuance of a Taxpayer Identification Number (TIN), BIR Certificate of Registration (COR), and other documents for tax compliance purposes.

STEP 4: Employer Registrations

If you are planning to hire employees, it is recommended that you also start to process your employer registrations with the Social Security System (SSS), Philippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (Pag-Ibig Fund).

STEP 5: Open a Corporate Bank Account

After securing all the business documents, you can finally open a corporate bank account registered with your company name. It is crucial that you consider the availability of banking facilities, including payroll, tax filing, and remittance of statutory contributions.

Business Registration Requirements in the Philippines

There are a set of requirements for each government agency. Note that these requirements may vary due to updates in rules and regulations.

SEC Registration Requirements

You may register your business with the Securities and Exchange Commission (SEC) through the SEC Electronic Simplified Processing of Application for Registration of Company (eSPARC). The online application system requires the following:

Proposed Business Name

Applicant or Authorized Representative’s Details

Company Type and Industry

Description of the Business

Office Address

Corporate Term

Incorporator’s Details

Capitalization

Corporate Officers

Date of Annual General Meeting

Fiscal Year

Name Appeal, if the proposed business name is rejected or unavailable

Additional requirements, if applicable

Business Permit Requirements

The requirements for business permits may vary across Local Government Units (LGUs). In this regard, you must coordinate with your city or municipal Business Permits and Licensing Office (BPLO). However, the documentary requirements usually include:

BPLO Application Form

Application Form for Other Clearances and Permits

Lease Contract or other equivalent documents

Certificate of Occupancy

SEC Certificate of Incorporation

Locational Map via Google Maps

Pictures of Office Location

Corporate Logo

List of Employees, if applicable

Employee’s Medical Certificate, depending on the LGU

Other Certificates and Affidavits, depending on the LGU

Board Resolution and Secretary’s Certificate, if processed by an authorized representative

BIR Registration Requirements

The following documents must be submitted when applying for a business registration with the Bureau of Internal Revenue (BIR):

Application for Registration or BIR Form 1903

Application for Authority to Print Official Receipts and Invoices or BIR Form 1906

Application for Registration Information Update or BIR Form 1905

Photocopy of SEC Certificate of Incorporation, for domestic corporations

Photocopy of SEC Certificate of Recording, for partnerships

Photocopy of License to Do Business in the Philippines, for foreign corporations

Articles of Incorporation

Notarized Lease Contract or other equivalent documents

BIR Printed Receipts and Invoices or final and clear sample of principal receipts and invoices

Books of Accounts

Franchise Documents, for common carriers

Memorandum of Agreement, for joint ventures

Franchise Agreement, if applicable

Certificate of Authority, for Barangay Micro Business Enterprises (BMBE) registered entity

Proof of Registration or Permit to Operate with BOI, BOI-ARMM, SBMA, BCDA, PEZA, etc., if applicable

Board Resolutions and Secretary’s Certificates, if processed by an authorized representative

SSS Employer Registration Requirements

Below are the documents required when processing an employer registration with the Social Security System (SSS):

Employer Registration Form or SSS Form R-1

Employment Report or SSS Form R-1A

Specimen Signature Card or SSS Form L-501

SSS Web Registration for Employer Form

List of Employees and their Details

Business Registration Documents

Authorization Letter, if processed by an authorized representative

PhilHealth Employer Registration Requirements

The following documents must be submitted when processing an employer registration with the Philippine Health Insurance Corporation (PhilHealth):

PhilHealth Employer Data Record or ER1

PhilHealth Report on Employee-Members or ER2

PhilHealth Online Access Form 001 or POAF 001

PhilHealth Employer’s Engagement Representative (PEER) Information Sheet

List of Employees and their Details

Business Registration Documents

Authorization Letter, if processed by an authorized representative

Pag-IBIG Fund Employer Registration Requirements

Below are the requirements when processing an employer registration with the Pag-IBIG Fund:

Employer’s Data Form (EDF)

Specimen Signature Form

eSRS Employer Enrollment Form

Employer’s Virtual Pag-IBIG Enrollment Form

Duly Received/Stamped SSS Form R-1A

Business Registration Documents

Authorization Letter, if processed by an authorized representative

Corporate Bank Account Opening Requirements

Each banks have different requirements, but it usually includes the following documents:

Customer Information Form

Account Details Form

Online Banking Form

System Administrator Designation Form

Signature Cards

Corporate Secretary Certificate

SEC Certificate of Incorporation

Company Bylaws

General Information Sheet (GIS)

Photocopies of valid IDs of signatories

It is advisable to check the official websites of the government agencies to be informed about the latest requirements as it may change from time to time.

Business Registration Costs in the Philippines

Here are the sample breakdown of business registration fees on each government agencies:

SEC Registration Fees

Type of Fees | Cost |

SEC Registration (⅕ of 1% of the authorized capital) | PHP 2,000 |

Stock and Transfer Book (STB) Registration | PHP 150 |

Company Bylaws | PHP 1,000 |

Name Verification and Reservation | PHP 100 |

Documentary Stamp Tax (DST) | PHP 30 |

Legal Research | PHP 30 |

TOTAL AMOUNT: PHP 3,310 | |

Business Permit Fees

Type of Fees | Cost |

Mayor’s Permit, Business Tax, and other local fees | PHP 2,500 |

Community Tax (Cedula) | PHP 500 |

Zoning Fee | PHP 100 |

Barangay Clearance | PHP 1,000 |

Business Plate | PHP 500 |

Comprehensive Liability Insurance | PHP 1,570 |

TOTAL AMOUNT: PHP 6,170 | |

BIR Registration Fees

Type of Fees | Cost |

Annual Registration | PHP 500 |

BIR Certification | PHP 115 |

DST on Shares | PHP 5,000 |

DST on Lease | PHP 960 |

Books of Accounts | PHP 300 |

Official Receipts and Invoices | PHP 5,000 |

TOTAL AMOUNT: PHP 11, 875 | |

Other Expenses

Type of Fees | Cost |

Notary, Transportation, Printing, etc. | PHP 20,000 |

Stock and Transfer Book (STB) | PHP 470 |

Dry Seal | PHP 2,500 |

Frames for Certificates and Permits | PHP 500 |

Initial Deposit for Corporate Bank Account | PHP 50,000 |

TOTAL AMOUNT: PHP 73, 470 | |

Note that these fees may vary depending on your location, availability of own resources, and preferred bank. This is only an estimate to help you prepare your budget.