Business registration is required when setting up a business in the Philippines. Without a business registration, you can’t legally operate a business in the country. This doesn’t only prohibit you from operating your business but also lose your opportunity to connect with investors, gain partnerships, and build strong relationships with your clients.

A business address is also required when registering your business. However, you don’t have to worry if you don’t have a physical office space since you can use a virtual office address.

What is a Virtual Office?

A virtual office is ideal for startups, small and medium-sized enterprises (SMEs), and international businesses seeking a practical and cost-effective solution to setup their business. It also serves as a professional business address and mailing address without the need of renting or buying a traditional office space. Additionally, a virtual office allows employees to work remotely and eliminates expenses like rent, utilities, and travel.

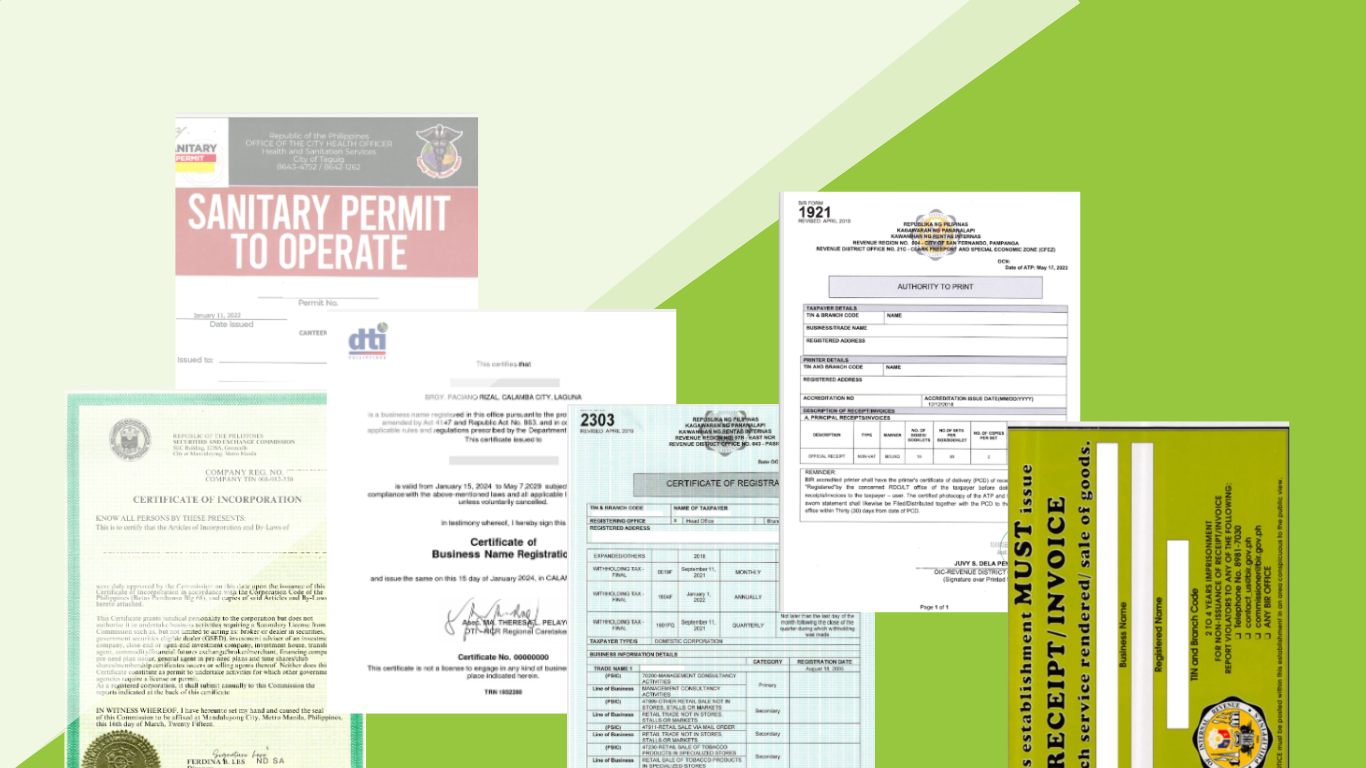

Requirements for Business Registration in the Philippines

The following documents are required when registering your business in the Philippines:

Requirements for Department of Trade and Industry (DTI) Business Registration

- Duly Accomplished Business Name Registration

- Valid government-issued ID

- Certified copy of Alien Certificate of Registration (ACR), for foreign nationals

- Certificate of Registration for Sole Proprietorship or Certificate of Authority to engage in business in the Philippines, for foreign nationals

Requirements for Securities and Exchange Commission (SEC) Business Registration

- Articles of Incorporation

- By-laws

- Registration Data Sheet

- Cover Sheet for Registration

- Joint Affidavit of Undertaking to Change Name, in case the business name you applied for is already taken and allowing you to change your business name

- Endorsements or Clearances from other government agencies, if applicable

Requirements for Barangay Business Clearance

- Two (2) valid government-issued IDs

- Proof of a Valid Business Address

- Department of Trade and Industry (DTI) Certificate of Registration

Requirements for Mayor’s Permit or Business Permit

- Two (2) valid government-issued IDs

- Proof of a Legitimate Business Address

- DTI Certificate of Registration

- Barangay Business Clearance

Requirements for Bureau of Internal Revenue (BIR)

- Two (2) valid government-issued IDs

- Proof of a Valid Business Address

- DTI Certificate of Registration

- Barangay Business Clearance

- Mayor’s Permit

Requirements for Authority to Print (ATP)

- Three (3) copies of BIR Form 1906

- Sample of Principal and Supplementary Receipts or Invoices

- Copy of Certificate of Registration

Process of Business Registration in the Philippines

Follow these procedures when registering your business:

1.) Check Availability of Business Name

Ensure that your chosen business name is not yet registered or owned by another business. You may confirm its availability on the official website of the Department of Trade and Industry (DTI).

2.) Register Business Name with DTI

For sole proprietorship, file an online registration through the Business Name Registration System (BNRS). After you’ve accomplished the registration form, you will receive a reference number or code and will be asked to pay the necessary fees. Once paid, you may claim your Certificate of Registration from the Department of Trade and Industry (DTI).

3.) Register Business Name with SEC

For corporations and partnerships, fill out an application form from the Securities and Exchange Commission (SEC) and submit the required documents. You will be asked to pay the necessary fees. After paying and completing the application, you may claim your Certificate of Registration from the SEC.

4.) Get a Barangay Business Clearance

Visit the barangay where your virtual office address is located. Submit the application form along with the requirements to claim your barangay business clearance.

5.) Get a Mayor’s Permit or Business Permit

After acquiring the Barangay Business Clearance, submit the application form and the required documents to the same barangay to claim your Mayor’s Permit or Business Permit.

6.) Register Business with BIR

When registering with the Bureau of Internal and Revenue (BIR), you should visit your respective Revenue District Office (RDO). Pay the registration fee for proof of payment Annual Registration Fee (ARF) and submit the registration forms and a photocopy of your payment receipt. Once submitted, you may claim your Certificate of Registration and purchase and register your book of accounts, where you keep all your business receipts and transactions.

7.) Acquire an ATP

An Authority to Print (ATP) allows you to print receipts and invoices for your customers and clients. To get an ATP, submit the BIR Form 1906 along with the other requirements.

Legal Compliance for Business Registration Using a Virtual Office Address

When using a virtual office address in the Philippines for business permits and legal compliance, keep these important points in mind:

1.) Business Registration with DTI and SEC

Registering your business is the most important legal step you should take. For sole proprietorships, you must register with the Department of Trade and Industry (DTI) while for corporations or partnerships, you must register with the Securities and Exchange Commission (SEC).

When registering your business, you will be required to provide a business address. If you don’t have a physical location, you don’t have to worry since you may register by using a virtual address. However, you must verify with the DTI and SEC if your virtual office address is acceptable in your intended operating area since some regions have zoning requirements for businesses.

2.) Barangay Clearance and Business Permit

In the Philippines, businesses are required to secure barangay clearance and business permits to operate legally, attest that their business is located within the jurisdiction, and serve as a compliance with the regulations.

When applying for these permits, you will be required to provide a business address. A virtual office address can be used as your business address to successfully acquire these documents.

3.) Tax Registration with the BIR

The Bureau of Internal Revenue (BIR) requires businesses to provide their business address when applying for a Tax Identification Number (TIN) and when filing tax returns.

Instead of using your home address, a virtual office address can be used to maintain your privacy while complying with tax requirements. However, as the BIR sends tax-related notices, make sure that your virtual office provider sends your mails promptly to your mailing address.

4.) Receiving Legal Documents

Important documents such as tax notices and legal papers are sent to your business address. A virtual office ensures that these documents are properly received and sent to your mailing address, and guarantees to avoid any cause for you for any delays or missed deadlines. Additionally, it is essential to choose a provider with reliable mail forwarding and call handling.

Final Thoughts

Establishing a business can be stressful since you can’t just simply market your products or services without complying with legal requirements Registering your business ensures that you are legally authorized to operate in the Philippines. It also prevents you from facing any problems in the future, such as imprisonment, penalties and business closure.

In today’s modern business world, companies of all sizes are striving to expand their reach and connect with skilled professionals globally. One of the key advantages of using a virtual office is that it allows you to focus on business growth while staying compliant with legal and regulatory requirements. Additionally, a virtual office enhances your company’s credibility and projects a professional image to potential clients and partners.